Summary:

In 2024, the ranking of China's top papermaking enterprises remains largely

stable compared to 2023, according to CCM market intelligence. Chenming, Huatai, Jiulong,

and Taiyang continue to lead the pack, maintaining their top four positions

since 2009. Despite overall stability, individual rankings have seen

significant shifts. While top-spot revenues and entry thresholds have

traditionally climbed, 2024 marks the first decline in years. Leading

enterprises, like Taiyang Paper and Shanying International, have accelerated

overseas investments. The average size of the top 20 enterprises has shrunk,

and CCM predicts ongoing fluctuations in future rankings.

Stable Leadership in China's Papermaking Industry

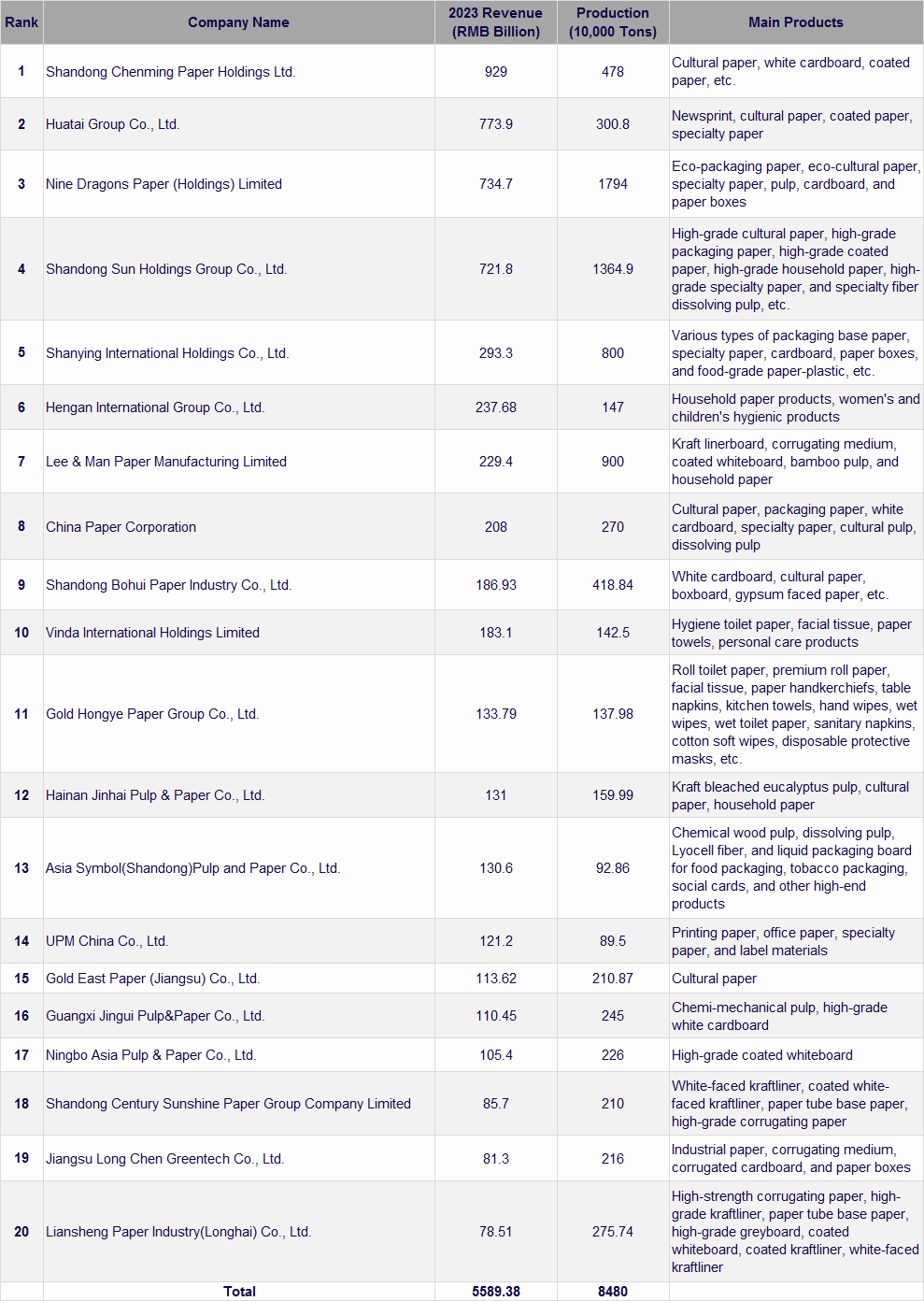

The list of China's top 20 papermaking enterprises for 2024

remains remarkably unchanged from the previous year, reflecting a consistent

lineup of industry leaders over the past five years. According to CCM market intelligence,

despite the overall stability, individual enterprises have experienced notable

shifts in their rankings. Chenming, Huatai, Jiulong, and Taiyang continue to

dominate the top four spots, a position they have held since 2009, indicating a

well-established hierarchy within the industry.

TOP 20 Papermaking Enterprises in China in 2024

Rising Thresholds and Declining Trends

Since 2019, the top spot and the threshold for entry into the

top 20 have consistently climbed. In 2023, the top enterprise surpassed the RMB

100 billion revenue mark, while the threshold reached RMB 8 billion. However,

the 2024 list fails to sustain this upward trajectory, marking the first

decline in years for both the top spot and threshold revenue. This change

signals potential shifts in the industry's dynamics and the challenges faced by

leading enterprises.

Accelerating Overseas Investments

In response to the ban on imported waste paper, insufficient

domestic demand, and international trade disputes, China's leading papermaking

enterprises, as highlighted in CCM Industrial Reports, have accelerated their overseas

investment strategies. These enterprises, with accumulated strengths, are

making new investment layouts with a global perspective to optimize resource

allocation for raw materials and products worldwide. This shift reflects the

maturity and growth of China's papermaking industry.

For instance, Taiyang Paper's Laos "forestation-pulping-papermaking

integration" project exemplifies sustainable development efforts.

Meanwhile, Shanying International's global strategy, deeply rooted in China

while spanning the US, UK, Sweden, and Norway, underscores its commitment to

international expansion. Despite the impact of the COVID-19 pandemic on

overseas strategies in recent years, each enterprise has developed unique

strategies to navigate domestic market challenges, as per CCM industry information.

Declining Average Size of Top Enterprises

The average size of the top

20 enterprises in 2024 has shrunk compared to the previous year, with an

average income of RMB 27.946 billion, reverting to the level of the 2022 list.

This decline is attributed to the widespread revenue decline of enterprises due

to various industry challenges in 2023. CCM market intelligence anticipates ongoing fluctuations in the list

of China's top 20 papermaking enterprises in the coming year.

About CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.